Marion County 2024 Real Estate Tax Bills Released: Key Details

January 18, 2025 - 11:07

The first half of the 2024 real estate tax bills for Marion County have been issued, with a due date set for February 5. Property owners are encouraged to review their bills promptly to ensure timely payment and avoid penalties.

Payments can be made through various convenient methods, including in-person at designated locations, by mail, or online through the county's official payment portal. Additionally, several local banks will also accept tax payments, providing further options for residents.

It is essential for property owners to be aware of any changes in their tax assessments or rates that may have occurred since the last billing cycle. Keeping track of these details can help avoid unexpected financial burdens. As the due date approaches, taxpayers are advised to plan accordingly to meet the deadline and maintain good standing with local tax authorities.

MORE NEWS

February 4, 2026 - 10:31

Claire Sucsy, “vivacious spirit” and successful real estate broker, dies at 89Claire Lyle Sucsy, a beloved figure known for her vibrant personality and professional acumen, passed away peacefully on January 24, 2026. She was 89 years old. Her life was a testament to warmth,...

February 3, 2026 - 22:38

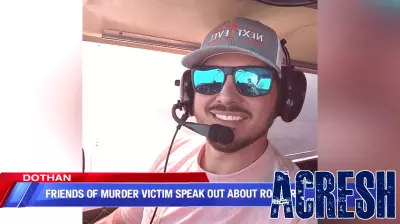

Friends reflect on the life of real-estate developer, race car driver killed in alleged robberyThe Wiregrass community is in mourning following the tragic death of 48-year-old Blake Bowen, a well-known local real estate developer and passionate race car driver. Bowen was found deceased in...

February 3, 2026 - 02:37

Simon Property Group Q4 Earnings Call HighlightsSimon Property Group executives detailed a period of significant financial and operational strength during their recent fourth-quarter earnings discussion. The company announced record funds from...

February 2, 2026 - 22:41

Foreign Commercial Real Estate Capital Rethinks the U.S.The landscape for foreign investment in American commercial real estate is undergoing a significant shift. While international capital is not exiting the market en masse, a new era of heightened...